Supervisory Framework

The management of loan and credit claims, i.e. a debt owed by a natural person or a company against a loan or credit received from a bank or other financial institution in Greece, is governed by a strict regulatory framework, which has been established by the Greek State with specific legislation, and the Bank of Greece as the Supervisory Authority with policies and instructions.

Specifically, pursuant to Law 4224/2013, the Bank of Greece established in August 2014 the Code of Conduct for the management of non-performing private debts, with effect from December 31, 2014. In August 2016, the Revised Code of Conduct was issued by the decision of the Credit and Insurance Committee of the Bank of Greece (195/1/29.07.2016, Government Gazette B, No 2376). Subsequently, decision No 392/1/31.05.2021 of the Credit and Insurance Committee of the Bank of Greece revised the Code of Conduct again and repealed the above-mentioned decision No 195/1/29.07.2016 of the Credit and Insurance Committee.

The Code was drawn up based on best international practices and describes the steps to be followed by borrowers, as well as banks and debt management companies, including the information required to be exchanged in order to identify the most suitable solution for each case.

Independent governance

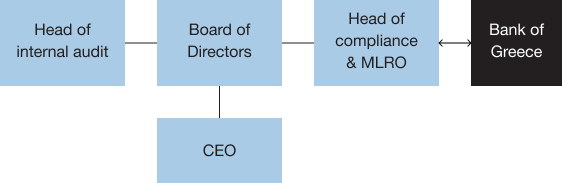

At Quant, we put into practice whatever is provided for in the Greek legislation and regulatory framework, and we apply internationally recognised corporate governance practices for effective and fair servicing of claims from loans and credits. The company has been licensed by the Bank of Greece and is supervised by it. Quant has set up inspection bodies referring directly to the Board of Directors to ensure good corporal governance.

More specifically, the corporal governance of Quant determines the assignment of tasks and powers within the organisation by establishing the following:

- a Board of Directors

- Committees

- a Code of Ethics QUALCO Group Code of Ethics and Standards of Professional Conduct – The Code applies to the total of our human resources. It provides a framework of principles, rules, conduct and decisions we must adhere to in our professional activities.

- Internal Audit System – It ensures the efficiency, reliability and compliance of our company with the legal and regulatory framework

- External Auditors

Leadership

The Board of Directors of QQuant Master Servicer Single Member S.A. comprises a majority of non-executive members with a long experience in the banking, industrial and counselling sectors in Greece, Central and Southeastern Europe. The company’s executives are acclaimed professionals with deep knowledge and expertise in the granting, servicing and restructuring of private and business, as well as in risk management and investment banking in large Greek banks.

Structure of corporate governance

Driven by integrity and transparency, our organisation’s corporate governance is structured as per below:

ESG

Creating substantial value

We aim to create value for our investors and all interested parties while contributing to broader social and environmental purposes.

- Vulnerable customers: We offer fair and viable solutions by determining any financial vulnerability.

- Financial Awareness: We help our customers realise their financial situation by providing solutions and choices for their economic recovery.

- Focus on innovation: We contribute to the development of our people by offering opportunities for career development in conjunction with rewards and recognition.

Our commitment

We aim to create a culture that will make a difference for us and the community.

- We are committed to minimising any direct or indirect environmental impact for a more sustainable future

- We create conditions which promote diversity, inclusion and security for our people.

- We act with integrity, transparency and responsibility in compliance with national and European laws.

All the practices we implement, as well as our impact on the environment, society and governance, are included in our Sustainability Report.

Reporting irregularities

We apply a procedure for the filing, receiving and monitoring of reports via an online platform to report European law breaches in sectors such as financial services, anti-money laundering and terrorism financing, environmental protection, public health, consumer protection, protection of privacy and personal data, security of networked systems and information etc. as well as the protection of the persons reporting such breaches. More specifically, in the context of their professional duties, employees and all third parties cooperating with the company are entitled to file a relevant report, thus contributing to the timely and effective detection, disclosure and response to incidents and risks and the adoption of proactive and corrective measures for the prevention of such irregularities in the future.

All reports are filed through the established internal channels (in writing, orally or via the company’s online “Whistleblowing Platform”) and are immediately investigated in the strictest confidence and confidentiality, ensuring personal data protection.